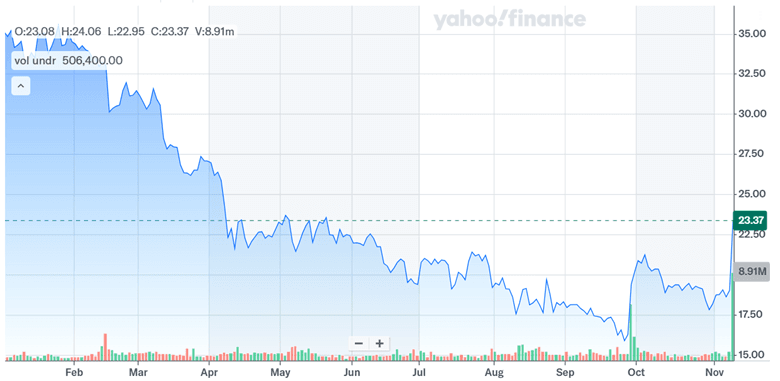

TreeHouse Foods (NYSE:THS) has suddenly become the center of attention, and if you’ve been following the packaged‑food space, you’ve probably noticed why. On November 10, 2025, the small-cap food manufacturer revealed that European private equity firm Investindustrial plans to buy the company for $2.9 billion in cash. That means TreeHouse shareholders would receive $22.50 per share plus a contingent value right—an offer that represents a surprisingly large premium compared to where the stock was trading before rumors began swirling in September. Investors reacted instantly, sending the shares up 20% before the market even opened. What makes the timing so interesting is that TreeHouse had just reported quarterly results that were weaker than expected and even pulled its full-year guidance. Still, Investindustrial seems to see long-term potential beneath the short-term noise. So, what exactly might they be seeing? Let us walk through the key factors that could be driving this deal.

Margin Expansion Strategy & Operational Discipline

One of the clearest reasons Investindustrial could be eyeing TreeHouse Foods is the company’s intense focus on profitability and margin expansion throughout 2025. TreeHouse has executed a comprehensive margin management program, restructuring its portfolio by exiting lower-margin products, streamlining operations, and shutting down underperforming plants. This strategy involved shifting production across a flexible plant network and winding down certain SKUs and ready-to-drink segments. These changes, while compressing volumes in the short term, have helped lift adjusted EBITDA margins to 9.1% in the most recent quarter. The company also maintained strong supply chain execution and achieved $10.6 million in year-over-year operational savings. With a longer-term target of $250 million in supply chain savings by 2027, Investindustrial could view TreeHouse as an operational turnaround story in progress. The PE firm could accelerate this transformation, tighten costs further, and push margin leverage through private ownership away from quarterly scrutiny. TreeHouse’s moves also align with a broader industry trend—packaged food manufacturers prioritizing earnings quality over volume growth. This disciplined approach is reflected in TreeHouse’s margin-accretive behavior, such as turning away lower-return business and pricing for complexity. For a sponsor like Investindustrial, experienced in mid-cap European turnarounds, the roadmap for cost optimization and long-term profitability is already in motion, with ample room for additional efficiencies under private control.

Exposure To Fast-Growing Private Label Food Trends

TreeHouse Foods plays in a resilient and growing corner of the grocery market—private label packaged foods. Across the U.S., consumers have increasingly turned to private brands for better value, and retailers have responded by investing more heavily in their store-brand offerings. During the second quarter earnings call, TreeHouse’s CEO emphasized this secular tailwind, highlighting that private brands continue to take or maintain share from national brands despite softer overall consumption. Retailers like Walmart and ALDI are doubling down on private brands, creating more runway for TreeHouse to partner and scale. These partnerships could become deeper under Investindustrial’s ownership, particularly if capital can be allocated more aggressively to support category leadership in coffee, tea, snacks, and condiments. Categories like coffee—especially in the value-focused ground segment—are showing resilience, and TreeHouse’s recent acquisition of the Northlake facility and Harris Tea gives it enhanced capabilities in key growth areas. Innovation is also on TreeHouse’s radar, but as a "fast follower" rather than a first mover, the company benefits from reacting to proven branded successes. This lowers R&D risk while allowing TreeHouse to roll out seasoned pretzels, cold brew coffee, or bone broths that mimic national trends. From an acquirer’s lens, being plugged into a small-cap company with this level of private label embeddedness and category diversification offers a built-in growth hedge, particularly in a consumption environment where affordability is top of mind for shoppers.

Strong Free Cash Flow & Balance Sheet Flexibility

For a small-cap, TreeHouse has consistently emphasized free cash flow generation and disciplined capital allocation—two features that tend to appeal to private equity buyers. The company reiterated its free cash flow guidance of at least $130 million for the full year, supported by leaner operations, price increases to offset commodity inflation, and structural cost reductions. On the balance sheet side, TreeHouse has been methodically building cash and aims to reach a target net debt-to-EBITDA range by year-end. This positions the company well for leveraged buyout (LBO) financing, especially since its asset-heavy manufacturing footprint and predictable EBITDA profile offer ample collateral support. From an acquirer’s perspective, this cash generation supports debt servicing, dividend recaps, or reinvestment in high-return segments like beverages and snack foods. Furthermore, the company’s capital allocation priorities have shifted toward organic and inorganic expansion in high-performing categories like coffee and tea—where scale and vertical integration can lead to further margin tailwinds. Investindustrial can bring operational and capital firepower to deepen this expansion and potentially layer on additional tuck-in acquisitions. Given TreeHouse’s high gross margin categories and exit from more commoditized segments like ready-to-drink beverages, it now operates a tighter portfolio focused on cash-accretive assets—exactly the type of profile private equity targets to compound returns post-acquisition.

Valuation Discount & Take-Private Opportunity

TreeHouse’s recent trading multiples suggest the company is undervalued relative to its longer-term cash flow potential and peer group. As of November 10, 2025, TreeHouse trades at a trailing EV/EBITDA multiple of just 7.43x and a price-to-sales (P/S) ratio of only 0.35x. Its forward EV/EBITDA stands at 7.46x, reflecting modest growth expectations but also indicating an entry point well below the historical average for food manufacturers, which often range from 9x to 12x in similar transactions. These compressed valuations stem from near-term headwinds such as lower volumes, margin resets, and the Griddle recall impact earlier this year. However, with forward EV/revenue multiples still under 1x (0.82x) and free cash flow yields rebounding to 12.7%, TreeHouse presents a compelling take-private candidate. The valuation math works in Investindustrial’s favor, offering potential for multiple expansion as operational improvements stabilize and the market re-rates TreeHouse’s cash profile. Moreover, by taking the company private, Investindustrial can shield the margin-accretive work from public market scrutiny, execute plant consolidations at a faster pace, and potentially position the firm for a strategic exit in several years—either through a re-IPO or sale to a strategic buyer seeking scale in U.S. private label manufacturing.

Final Thoughts

Source: Yahoo Finance

We see a notable uptick in the stock price of TreeHouse Foods after Investindustrial’s $2.9 billion buyout interest. From a valuation standpoint, TreeHouse looks relatively cheap, trading at a trailing EV/EBITDA of 7.43x and P/S of 0.35x—multiples that could justify a buyout premium. However, it is important to note that TreeHouse sits at a crossroads: it is working hard to improve profits, reshape its operations, and tap into the long-running shift toward private-label groceries. Those are clear positives and likely part of what caught Investindustrial’s eye. At the same time, TreeHouse isn’t without challenges. Consumer demand has been soft, volumes are still under pressure, and the company recently missed expectations and withdrew its guidance. That’s not nothing. Whether Investindustrial ultimately completes the deal or not, TreeHouse remains a small-cap to watch as the industry continues to consolidate and focus shifts toward profitability over raw volume growth.