Avadel Pharmaceuticals (NASDAQ:AVDL) is at the center of a high-stakes acquisition drama that’s heating up the biotech sector. The small-cap sleep disorder therapy company recently disclosed that it received an unsolicited buyout proposal from Danish drugmaker Lundbeck, offering up to $23 per share—a clear premium over a prior $20-per-share bid by Alkermes. Avadel’s shares jumped nearly 17% in premarket trading as investors processed the new development, which injects fresh uncertainty into an already active M&A landscape. While Avadel had previously agreed to an all-cash $2.1 billion acquisition by Alkermes, its board has yet to declare Lundbeck’s offer superior, maintaining support for the original agreement. Both offers include contingent value rights (CVRs), which tie a portion of the payout to regulatory or commercial milestones. This means the ultimate value to shareholders could vary significantly depending on future drug approvals or sales metrics. With major strategic incentives at play—especially around Avadel’s flagship drug, LUMRYZ—investors should closely watch how this evolving situation unfolds.

Higher Competing Bid From Lundbeck Creates Immediate Valuation Upside

Lundbeck’s unsolicited proposal to acquire Avadel at a headline value of up to $23 per share presents an immediate financial advantage for shareholders, compared to the $20 per share offered by Alkermes. The bid comprises $21 in cash upon deal closure and an additional $2 through a non-transferable CVR tied to commercial milestones for LUMRYZ and valiloxybate. That’s $1.50 more in guaranteed cash than Alkermes’ offer, which included $18.50 upfront and a $1.50 CVR dependent on FDA approval of LUMRYZ for idiopathic hypersomnia in 2028. Investors responded swiftly to this premium, with Avadel’s stock rallying in the premarket following the announcement. From a valuation standpoint, the implied offer boosts Avadel’s enterprise value, which had already increased materially through 2025. On a forward basis, Avadel now trades at 6.53x NTM revenue and 30.55x EBITDA, far above its historical multiples, suggesting the market is beginning to price in a potential deal premium. While Lundbeck’s bid is clearly more generous in the short term, it’s also a strong strategic fit. Lundbeck has a long-standing focus on neuroscience and sleep disorders, and the addition of LUMRYZ could bolster its CNS portfolio by giving it a once-nightly oxybate product with strong commercial momentum and expansion potential. In contrast to Alkermes, which has broader operations in psychiatric and addiction therapy, Lundbeck may be able to extract more synergies from Avadel’s focused platform. For shareholders, this higher cash component and better potential product alignment increase the attractiveness of Lundbeck’s proposal, at least on paper.

Potential For A Bidding War Increases The Likelihood Of An Even Better Offer

Lundbeck’s unexpected entrance into the acquisition process has significantly changed the deal dynamics, increasing the chances of a bidding war that could push the offer price even higher. Alkermes’ original $2.1 billion bid appeared solid when announced in October, especially with its all-cash structure and promise of a CVR tied to future FDA approval. However, the presence of two motivated bidders—each with a distinct strategic rationale—opens the door for a more competitive bidding environment. Lundbeck clearly sees long-term value in LUMRYZ and its growth prospects in both narcolepsy and idiopathic hypersomnia. Its move is not unlike Pfizer’s recent decision to outbid Novo Nordisk in the Metsera deal, signaling that strategic acquirers are willing to pay up for differentiated assets, particularly in the sleep and metabolic disease categories. Avadel’s performance has strengthened considerably in recent quarters, with Q2 2025 marking its first-ever net income and a solid $68.1 million in LUMRYZ revenue—up 64% year-over-year. It also raised its full-year revenue guidance to $265–$275 million. With 3,100 active patients and increasing physician adoption, the drug is gaining traction, which could further justify a higher acquisition price. The robust commercial performance, combined with high unmet need in idiopathic hypersomnia, makes Avadel a rare, high-growth target in the small-cap biotech universe. If Alkermes still sees strategic merit in the deal, it may be forced to revise its bid to stay competitive, especially since its CVR terms are somewhat less favorable than Lundbeck’s. This increases optionality for shareholders and keeps upward pressure on the final deal price.

Avadel’s Board Still Officially Supports Alkermes, Signaling No Guaranteed Deal Shift Yet

Despite the compelling nature of Lundbeck’s higher offer, Avadel’s board has not officially endorsed it or labeled it a "Company Superior Proposal" under its existing agreement with Alkermes. In fact, the company reiterated its support for the Alkermes deal shortly after Lundbeck’s proposal went public, stating that no changes had been made to its prior recommendation. This cautious stance introduces real uncertainty into the outcome and suggests that shareholders should not yet assume a higher deal is imminent or even likely. There are several potential explanations for this restraint. The board may be weighing legal obligations under the existing merger agreement with Alkermes, which could involve break-up fees or restrictions on negotiating alternative deals unless certain criteria are met. Another possibility is that the board wants more time to assess the credibility and specifics of Lundbeck’s CVR structure and financing plan. Until the board changes its recommendation, it’s possible that the Alkermes transaction will proceed as planned. This makes the situation fluid and emphasizes the importance of governance and contractual obligations in M&A scenarios. Additionally, the board may view Alkermes as a more operationally stable partner or one that offers better execution capabilities in launching LUMRYZ for new indications. In any case, investors need to be mindful that even with a higher bid on the table, no change in recommendation means there is no guarantee of a revised deal or auction process—at least not yet. That makes it crucial to watch for formal updates from Avadel in the coming weeks.

Lundbeck’s Offer Is Not Binding & CVR Milestones Add Uncertainty To Actual Payout

One critical factor that tempers enthusiasm for Lundbeck’s bid is that the proposal remains non-binding and subject to further negotiation and due diligence. While the $23 per share headline figure—comprised of $21 in cash and a $2 CVR—appears attractive, there is no formal agreement in place that locks in those terms. Until the offer becomes binding, there’s a risk that Lundbeck could revise, delay, or even withdraw its bid. This contrasts with the Alkermes deal, which is already under contract and carries more procedural certainty. Moreover, both bids involve contingent value rights, which add a layer of complexity and uncertainty to shareholder returns. Lundbeck’s $2 CVR is tied to sales performance of LUMRYZ and valiloxybate, though specific milestones remain undisclosed. In contrast, Alkermes’ $1.50 CVR hinges solely on FDA approval of LUMRYZ for idiopathic hypersomnia by 2028. These milestones may or may not be achieved, depending on regulatory outcomes and market adoption trends. For instance, while LUMRYZ recently received orphan drug designation for idiopathic hypersomnia and has shown solid growth in narcolepsy, clinical data from the ongoing Phase 3 REVITALYZ trial won’t be available until 2026. That leaves considerable execution risk over the next two years. As a result, the actual realized value from either transaction could fall short of the headline figures if the CVRs are not triggered. This risk needs to be carefully considered, especially by long-term shareholders evaluating whether to sell into the market now or wait for deal completion. A non-binding offer plus milestone-based payments means the path to full value realization remains far from guaranteed.

Final Thoughts

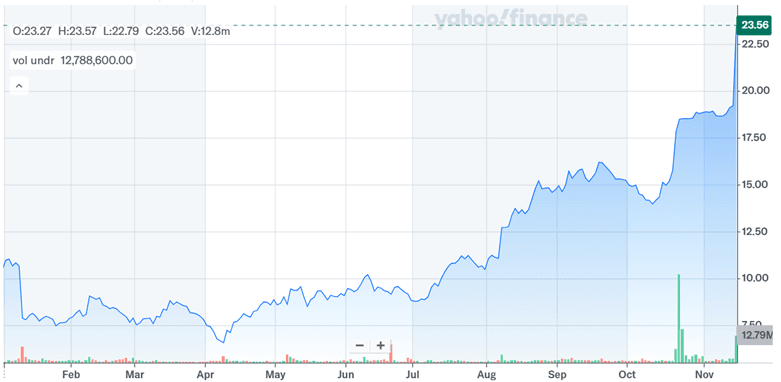

Source: Yahoo Finance

Avadel’s stock price has been on a roll with the unfolding of its acquisition saga and we can infer that the jump in the stock price as well as the volumes reflects the high strategic value placed on the company’s LUMRYZ franchise and pipeline potential. Lundbeck’s higher $23-per-share bid—including more upfront cash than Alkermes’ offer—offers clear short-term upside. However, the non-binding nature of the proposal, coupled with the use of CVRs in both bids, injects material uncertainty into the actual payout timeline and value. At the same time, Avadel’s board’s ongoing support for the Alkermes deal signals no automatic transition to a better offer, at least not yet. From a valuation standpoint, the company trades at a steep premium relative to historical LTM multiples, including 9.04x revenue and over 800x EBITDA, reflecting market optimism about a deal. Still, until one offer is finalized and binding, shareholders remain exposed to execution risk. Overall, the Avadel case study is slowly building up to become one of the most interesting biopharma acquisition case studies of 2025.