Avanos Medical (NYSE:AVNS) has been making headlines again — this time because WRS Group, a Michigan-based private company, has agreed to buy Avanos’ U.S. Game Ready orthopedic rental business. Starting December 1, 2025, WRS will officially take ownership of nearly all the Game Ready assets. As part of the deal, Avanos will keep manufacturing and supplying Game Ready systems and accessories while supporting WRS through the transition period. The idea is to make sure everything runs smoothly for customers, partners, and patients. This latest move fits neatly into Avanos’ bigger transformation plan, which already included selling off its hyaluronic acid (HA) product line earlier in 2025. By focusing on its two main businesses — Specialty Nutrition Systems and Pain Management & Recovery — Avanos is slimming down and sharpening its focus. That makes it an intriguing potential full-scale acquisition target for WRS Group. Let us dive deeper and explore the biggest reasons why WRS might see big potential in teaming up with Avanos.

Targeted Expansion Into High-Touch Orthopedic Markets With Embedded Infrastructure

WRS Group’s decision to acquire the U.S. Game Ready rental assets reflects a focused ambition to scale its presence in the high-margin, equipment-intensive orthopedic rehabilitation space. By securing distribution rights and infrastructure tied to Game Ready’s therapy systems, WRS is buying into a customer base that includes outpatient rehabilitation centers, sports medicine clinics, and hospital systems—a network that would otherwise take years to replicate organically. Avanos, despite being a small-cap player, has built a recognized footprint in this sector through its Game Ready brand, which offers cold and compression therapy widely adopted in post-operative care. Even though the business posted slightly lower year-over-year revenue in Q2 2025, it remains strategically valuable for WRS as an entry point into device-based recovery solutions. The ability to bundle Game Ready systems with broader rehabilitation offerings creates a sales crosswalk opportunity for WRS, enhancing its total addressable market. Moreover, by leveraging Avanos’ established logistics and product support capabilities through 2025, WRS can enter the market with immediate operational scale. Avanos will continue manufacturing and supplying the systems, ensuring product consistency while allowing WRS to focus on commercial execution. This division of roles reduces onboarding risk and lets WRS learn the operating model before deciding whether to deepen integration. Such a partnership model also lowers CapEx needs in the short term while granting WRS strategic flexibility to drive long-term orthopedic market expansion. With Game Ready as a foundation, WRS could position itself as a differentiated supplier in recovery therapeutics, a category with increasing demand from aging populations and elective procedure volume growth.

Synergistic Fit With Focused Supply Chain & Manufacturing Capabilities

Avanos’ ongoing transformation has centered on operational optimization and margin recovery—objectives that align closely with WRS Group’s likely investment thesis. As part of this transformation, Avanos has accelerated in-sourcing efforts, consolidated manufacturing in its Bethlehem, Pennsylvania facility, and targeted a full exit from China-based NeoMed product sourcing by H2 2026. These supply chain initiatives improve cost control, reduce geopolitical risk, and enhance gross margins—benefits that a potential acquirer like WRS could capitalize on. WRS gains access not only to finished products but also to a tightly controlled, vertically integrated manufacturing platform that can scale with additional product lines. With tariffs on China-origin goods imposing up to 145% in Q2 2025, Avanos’ reshoring strategy positions it as a less volatile supplier. Furthermore, the company has demonstrated pricing discipline, portfolio pruning, and asset-light manufacturing—skills that would be valuable if WRS intends to expand into adjacent medtech verticals. Avanos’ 2025 EBITDA margin improvement and operating leverage in Specialty Nutrition Systems signal that further scale could yield meaningful cost synergies. A buyer with WRS’s private capital flexibility could push these initiatives harder, free from the constraints of quarterly public reporting. The combination could also unlock volume-based procurement savings, reduce lead times, and stabilize unit economics across product categories. With adjusted gross margins of 55.7% and SG&A discipline lowering overhead to 45.2% of revenue, Avanos provides a framework that’s already partially optimized—an attractive asset for a supply chain-savvy buyer looking to improve EBIT without deep restructuring. These foundational efforts align with WRS’s strategy of building durable, cash-generating platforms in defensible niches.

Margin-Accretive Growth In Radiofrequency Ablation & Pain Management

Beyond orthopedics, Avanos has restructured its Pain Management & Recovery segment into a streamlined growth engine, led by its radiofrequency ablation (RFA) franchise. In Q2 2025, RFA posted nearly 14% revenue growth year-over-year, with strong generator sales and robust procedure pull-through on higher-margin probes. The business has benefited from a newly deployed sales force and a three-tiered product offering across ESENTEC, TRIDENT, and COOLIEF systems. WRS Group could see this as an adjacent therapeutic platform complementary to Game Ready’s post-operative pain recovery profile. By integrating RFA technologies, WRS could deepen its offering across the perioperative continuum, capturing physician preference from surgical to post-acute care. Moreover, international momentum for COOLIEF—buoyed by reimbursement gains in Japan and the UK—suggests global scalability that an acquirer could exploit. Avanos’ clinical focus and single-modality dedication make it a standout in the RFA space, particularly as hospitals seek non-opioid alternatives under the NOPAIN Act. Although surgical pain sales were down, they remain strategically relevant given regulatory incentives for opioid-sparing interventions. Operating profit for the segment, excluding goodwill impairment, increased by nearly $2 million in Q2—a testament to cost discipline and sales execution. For WRS, the ability to combine an orthopedic rental business with a proprietary interventional pain platform could create a uniquely integrated recovery solution across multiple care settings. Notably, Avanos’ cost structure in this segment has shown resilience even amid macroeconomic pressure, suggesting that scale could enhance unit profitability. The integration of both physical therapy equipment and interventional pain products under one portfolio could serve as a sales force unification lever while diversifying payer exposure. This depth in pain recovery could help WRS differentiate itself from generic DME or service-only competitors.

Strategic Optionality From Streamlined Balance Sheet & Divestiture Discipline

Avanos has spent the past several quarters streamlining its portfolio, exiting low-growth and non-strategic businesses, most notably through the recent divestiture of its hyaluronic acid (HA) line at the end of July 2025. Though financial details were undisclosed, the HA exit reduces exposure to pricing volatility in 3- and 5-shot categories and allows Avanos to concentrate on more scalable verticals. This disciplined approach to capital allocation, along with the company’s cash-generating core, presents WRS with a clean acquisition profile. As of June 30, 2025, Avanos held $90 million in cash against $105 million in debt, maintaining net leverage meaningfully below 1x. With free cash flow guidance of $40 million for FY25 and levered FCF yields above 10%, the business is generating sufficient liquidity to support strategic investment or integration. This capital efficiency allows a potential acquirer to focus on growth and commercial synergy rather than debt service or turnaround capital. Additionally, Avanos has shown a willingness to reinvest strategically, completing two tuck-in deals aligned with its Specialty Nutrition Systems strategy, signaling that accretive M&A execution is part of its operating playbook. For WRS, this may translate into optionality—either operate Avanos as a stand-alone platform with bolt-on growth or selectively integrate operations for synergy capture. The leadership overhaul, including a new CFO with deep transaction experience, reinforces this posture. The company’s Q2 impairment charge in Pain Management & Recovery reflected macro-driven market cap compression rather than operational deterioration, offering an entry point potentially below intrinsic value. With multiple divestitures now completed and cost actions underway, Avanos offers WRS a focused platform with limited legacy distractions.

Final Thoughts

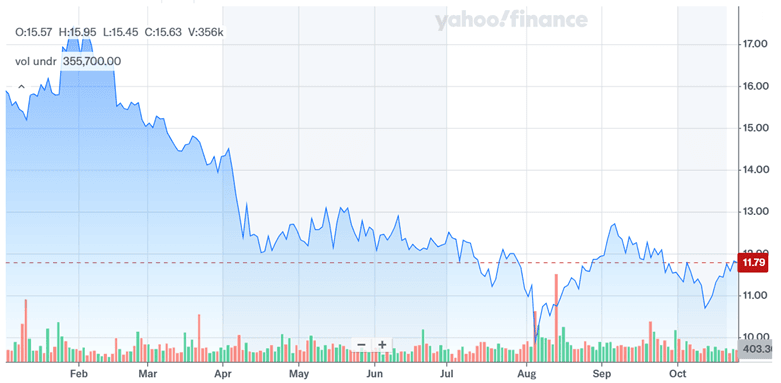

Source: Yahoo Finance

There are a lot of reasons why Avanos Medical could be an excellent buy for WRS and cheap valuation multiples is also one of them. Avanos trades at modest LTM multiples—0.86x EV/Sales, 6.73x EV/EBITDA, and a 9.51x Market Cap/FCF ratio—suggesting a reasonable, though not deep, discount to intrinsic value based on recent operational improvements. The company’s sharpened focus, operational streamlining, and targeted divestitures make it a more logical acquisition target today than it was two years ago. However, uncertainty remains around macroeconomic pressures, tariff impact, and ongoing portfolio realignment. Additionally, WRS or any other acquirer would need to navigate tariff-induced cost variability and scale operations without sacrificing product quality or customer retention. It will be very interesting to see how the future of Avanos evolves in the coming months.