Bowman Consulting Group (NASDAQ:BWMN), a small-cap player in the engineering consultancy domain, has been on an impressive growth trajectory off-late as it continues to expand its portfolio of high-margin, technology-enabled services. The company recently acquired the assets of California-based Sierra Overhead Analytics (SOA) and its technology affiliate ORCaS, two firms known for technology-centric civil design, precision mapping, and hydrology services. This move extends Bowman’s digital services and engineering reach across its core energy and infrastructure markets. With a stated focus on acquisitions in energy, transportation, and technology-enabled services, the SOA deal appears aligned with Bowman’s Office of Innovation initiative and its $25 million Bowman Innovative Growth Fund (“BIG Fund”). Let us dive deeper into these acquisitions and examine the biggest synergies from these deals.

Expansion Of Technology-Centric Engineering & Mapping Capabilities

Sierra Overhead Analytics specializes in precision mapping, hydrology, and technology-focused civil design, supported by proprietary automation tools developed by its affiliate ORCaS. This expertise complements Bowman’s existing geospatial and imaging business, which already serves federal, state, and commercial clients. By integrating SOA’s capabilities, Bowman could meaningfully enhance its digital surveying and mapping services, creating a more comprehensive end-to-end engineering solution for energy transmission, renewables, and infrastructure customers. This fits squarely into the three pillars of the BIG Fund—geolocation, high-resolution digital imaging, and artificial intelligence tools—which are designed to convert Bowman’s engineering data into long-term, recurring digital products. Bowman’s Q2 earnings call highlighted a deliberate effort to move from one-off capital expenditure-driven projects to ongoing operating and maintenance engagements, where data, analytics, and predictive modeling offer recurring revenue potential. SOA’s proprietary design automation and hydrological optimization tools may accelerate this shift, allowing Bowman to produce interactive 3D models, intelligent spatial analysis, and agentic AI applications that shorten permitting timelines and reduce engineering hours. Such efficiencies could enable Bowman to scale its labor force without linearly increasing costs, reinforcing its margin expansion strategy, which produced an 18.7% adjusted EBITDA margin in Q2—up 440 basis points year-over-year. The integration also broadens Bowman’s ability to compete for larger projects requiring geospatial and environmental precision, including major energy transmission corridors and renewable installations, where high-resolution mapping is a differentiator.

Strengthening Bowman’s Position In Energy Infrastructure & Transmission

Bowman has repeatedly emphasized its growing exposure to energy transmission and renewables, identifying these as tailwinds for long-term growth. In Q2, its Power, Utilities and Energy vertical delivered positive organic growth despite a competitive environment, supported by wins from its geospatial group and last year’s Surdex acquisition. Adding SOA’s hydrology and precision-mapping expertise could deepen Bowman’s foothold in transmission corridors, substation siting, and environmental planning—critical components for utilities navigating grid modernization and decarbonization mandates. These capabilities align with Bowman’s repositioning of data center work into its Power segment, where energy sufficiency has replaced latency as the main constraint for development. Data centers—among the most energy-intensive infrastructure projects—require integrated planning for power generation, distribution, and thermal systems, which Bowman now offers through its e3i acquisition. SOA’s proprietary ORCaS technology could complement this suite by modeling flood risks, terrain suitability, and water resource dependencies for high-voltage transmission or on-site substations. This integration strengthens Bowman’s ability to deliver end-to-end solutions—land acquisition, environmental permitting, substation integration, and on-site energy systems—helping it compete for longer-duration, higher-value engagements. As the U.S. federal government and utilities continue investing in renewable energy corridors, battery storage, and microgrids, Bowman’s combined offering with SOA positions it as a more attractive partner for clients seeking technology-enabled engineering. The ability to bundle precision mapping with civil and energy engineering could also reduce the need for third-party contractors, improving project control and potentially increasing gross margin capture per engagement—a key driver of the “scale effect” Bowman management underscored in its earnings call.

Driving Margin Expansion Through Labor Efficiency & Automation

One of Bowman’s biggest levers for profitability has been labor efficiency. Management attributes the Q2 margin expansion primarily to disciplined labor management—keeping total operating overhead flat even as net revenue increased 8% sequentially. SOA’s technology-centric approach could enhance this advantage by reducing manual engineering and data-processing hours. ORCaS’ proprietary tools enable specialized design automation and location optimization, which, once integrated into Bowman’s workflows, could significantly increase throughput per employee. This aligns with Bowman’s emphasis on moving away from one-to-one labor-to-revenue growth toward technology-enabled multiples of labor productivity. Internally developed AI and digital services funded by the BIG Fund are already being piloted across Bowman’s ports, harbors, and water resources groups. Adding SOA’s technology provides another layer of automation and digital asset creation, which can be monetized over time through maintenance, updates, and predictive analytics. This shift could help Bowman offset inflationary pressures on labor costs, which management acknowledged will persist in the second half of 2025. It also supports Bowman’s longer-term goal of sustaining high-teens adjusted EBITDA margins, which, at 16.7% year-to-date, are already trending higher than last year’s levels. As the company continues to scale, embedding SOA’s technology into its enterprise systems could amplify these productivity gains across multiple verticals—transportation, energy, natural resources, and building infrastructure—turning a one-time acquisition into a firm-wide operational catalyst. However, integration risk remains; if Bowman fails to fully absorb SOA’s tools or retrain staff accordingly, the potential labor efficiencies could be delayed or diluted, particularly as the company simultaneously ramps up larger projects in transportation and power.

Creating A Platform For Recurring & Lifecycle Engineering Revenue

Bowman’s management has been clear about its ambition to evolve from a project-based engineering firm into a lifecycle partner offering recurring services. The BIG Fund was explicitly designed to identify opportunities to deliver “life cycle engineering”—predictably assessing the state of infrastructure and engaging customers between projects. SOA’s hydrology and mapping services could act as a springboard for such recurring revenue. For example, precision mapping and hydrological modeling can be updated regularly to monitor environmental impacts, inform maintenance schedules, or comply with regulatory reporting—all of which could be sold as subscription-based services to utilities, developers, or government agencies. By integrating SOA’s tools with Bowman’s AI-driven initiatives, the company could create a digital twin of customer assets—bridges, substations, transmission corridors—allowing for continuous monitoring and predictive maintenance. This would shift Bowman from a purely CapEx vendor to a hybrid OpEx partner, expanding wallet share without significant incremental labor. The company’s diversified backlog—which grew 25% year-over-year to nearly $87 million at Q2—already reflects synergies from its adjacency-focused M&A program. SOA’s addition could accelerate this trend by embedding Bowman deeper into customer workflows, especially in regulated industries like energy transmission and water resources where ongoing compliance and environmental monitoring are critical. However, building a recurring revenue model requires significant upfront investment in systems, sales enablement, and client education, which could temporarily weigh on margins or cash flow. Bowman’s low leverage and strong cash conversion—nearly 50% of adjusted EBITDA year-to-date—gives it some capacity to make these investments, but execution risk will determine whether these services generate the high-margin, predictable revenue streams management envisions.

Final Thoughts

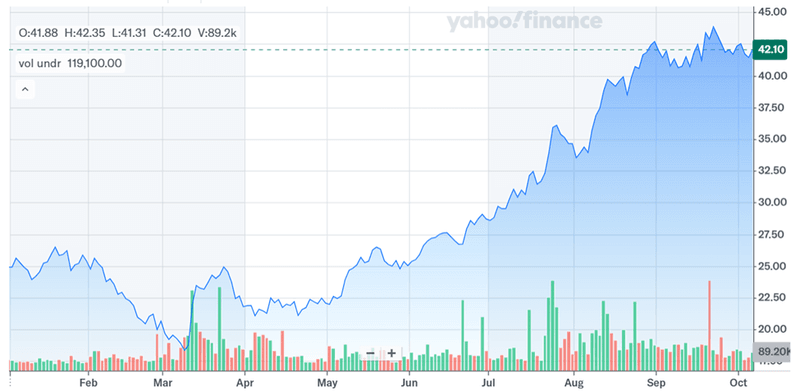

Source: Yahoo Finance

Bowman’s stock has had a strong upward trajectory over the past few months. The company’s stock trades at a trailing EV/EBITDA multiple of 21.86x and an LTM Price/Sales of 1.57x, reflecting a premium to its historical averages but supported by improving margins and backlog growth. Its acquisition of Sierra Overhead Analytics and ORCaS appears aligned with its strategy to expand technology-enabled services, strengthen its energy and transmission verticals, and transition toward lifecycle engineering revenue. Whether the SOA acquisition proves to be a catalyst for sustained multiple expansion or a strain on near-term resources will depend on Bowman’s ability to integrate, scale, and monetize these new capabilities without eroding its disciplined cost structure.