DarioHealth Corp. (NASDAQ:DRIO), a small-cap digital health platform specializing in chronic condition management, has initiated a strategic review following unsolicited interest from potential suitors. The company disclosed that it has formed a special committee of independent directors to explore a range of alternatives, including a possible sale, merger, or continuation as a standalone entity. Investment bank Perella Weinberg Partners has been retained as financial advisor to the process, which does not yet have a fixed timetable. The news follows an oversubscribed $17.5 million private placement in Q2 2025 that bolstered Dario’s cash reserves to approximately $40 million and coincides with broader industry consolidation in digital health. The surprise announcement has sent shares up over 40%, underscoring investor interest in the company’s potential strategic pivot.

Strategic Review & Potential Value Unlock

The initiation of a formal strategic review signals a pivotal moment for DarioHealth as it navigates both internal transformation and external opportunity. According to company disclosures and management commentary during the Q2 2025 earnings call, the board formed a special committee in response to credible, unsolicited buyout interest. This development is particularly noteworthy given that Dario is transitioning from a one-time revenue model to a high-margin SaaS-like recurring revenue structure, focused heavily on enterprise clients such as national health plans and self-insured employers. Management has confirmed that while discussions are exploratory, they are being undertaken with the support of Perella Weinberg Partners, suggesting a level of seriousness behind the suitor interest. While no guarantees have been made regarding the outcome, Dario's leadership emphasized that any decisions will be made with a focus on shareholder value creation. From a structural standpoint, Dario is well-positioned to evaluate options. Its B2B2C platform commands approximately 80% non-GAAP gross margins, with retention rates around 85% and a healthy cross-sell motion that targets an additional 10–15% expansion from existing clients. Moreover, the company is onboarding major accounts with national reach, including one expected to launch in the second half of 2025 and another in final-stage contracting. This momentum underscores the underlying enterprise value, particularly for potential acquirers looking to accelerate their presence in digital chronic care management. With $5 million in newly committed ARR and an additional $5 million in late-stage contracting, the commercial foundation has been laid, even if GAAP revenues have temporarily declined. As small-cap digital health companies increasingly become acquisition targets in a consolidating environment, Dario’s ongoing strategic review may provide a mechanism to surface latent value that is currently underappreciated by the public markets.

Strengthened Balance Sheet & Simplified Capital Structure

In anticipation of long-term operational scaling, DarioHealth has taken meaningful steps to fortify its financial position and streamline its capital structure. In Q2 2025, the company raised $17.5 million through an oversubscribed private placement, increasing its total cash and short-term investments to approximately $40 million. This liquidity buffer provides the company with sufficient runway to continue onboarding new clients, fund platform enhancements, and support AI-driven efficiency initiatives without relying on near-term capital raises. The company also completed a conversion of preferred stock into common equity, which simplifies the shareholder structure and potentially improves the attractiveness of the company to institutional investors and potential acquirers. Financially, despite a sequential decline in total revenues from $6.8 million in Q1 2025 to $5.4 million in Q2, driven by the nonrenewal of a legacy maternity program and delayed revenue recognition from new clients, Dario achieved 55% GAAP gross margin and 64% non-GAAP gross margin overall. Its core B2B2C segment continues to operate at approximately 80% non-GAAP gross margin. Operating expenses were down 36% year-over-year, and operating loss narrowed by 43%, reflecting the company’s aggressive implementation of AI-enabled automation and offshoring strategies. Management now targets an OpEx reduction of up to 15% over the next 12–15 months, aiming for quarterly expenses slightly above $8 million. These cost measures, combined with a high-retention, high-margin revenue base, position Dario to reduce cash burn even as it continues investing in growth. While cash flow breakeven has been deferred to late 2026 or early 2027, the financial framework has been derisked relative to its small-cap digital health peers. These efforts, alongside a lean and transparent capital structure, provide strategic optionality for both standalone execution and deal-making flexibility.

Sector Tailwinds & Consolidation Opportunity

The broader digital health sector is undergoing a wave of consolidation as acquirers—both strategic players and private equity firms—seek to gain scale, add vertical capabilities, and capture recurring revenue streams in an increasingly value-based healthcare environment. DarioHealth is strategically positioned within this trend, with a multi-condition digital platform that addresses cardiometabolic, behavioral health, musculoskeletal (MSK), and sleep disorders through integrated, AI-enhanced solutions. The company’s partnerships with benefit consultants, PBMs, and virtual care networks such as Amwell, Rula Health, and GreenKey demonstrate a clear intent to scale distribution through non-linear, channel-driven models. The industry’s shift toward bundled, ROI-anchored digital care aligns with Dario’s own outcomes data, which includes $5,000+ in medical cost reduction per engaged user and 5x ROI across programs. Moreover, the platform’s proven integration with GLP-1 utilization management, sleep health, and remote monitoring makes it attractive to payers aiming to curb high-cost therapies through behavioral reinforcement and digital engagement. Currently, Dario is live with over 100 clients, including 4 national health plans and 5 pharma companies, and it reports a pipeline of $53 million with multiple national-scale contracts in advanced stages. As the market increasingly rewards digital platforms that can offer end-to-end chronic care management with measurable outcomes and AI-driven personalization, Dario’s strategic posture appears aligned with what potential acquirers are seeking. Notably, recent transactions and IPOs in the space (e.g., Hinge Health, Omada) have shown valuation multiples in the 5–10x revenue range, far above Dario’s current LTM EV/Revenue of 1.57x and LTM Price/Sales of 1.21x. This valuation gap, when viewed through the lens of strategic M&A, creates a compelling case for why Dario may be viewed as an opportunistic acquisition target within a fragmented small-cap digital health landscape.

Outcome Uncertainty & Execution Risk

While the announcement of a strategic review has drawn attention to DarioHealth’s latent value, there are several execution risks and uncertainties that must be considered. Firstly, the company has experienced near-term revenue volatility, with Q2 2025 revenues of $5.4 million down from $6.8 million in Q1, and $6.3 million in the year-ago quarter. This decline was primarily attributed to the loss of a single large Medicaid maternity program inherited through the Twill acquisition, which was insourced by the client. While management emphasizes that such programs are non-core and not indicative of systemic client attrition, the temporary revenue shortfall has forced a delay in Dario’s cash flow breakeven timeline by 12 to 15 months. Additionally, the full impact of several large new contracts—one of which is set to launch in late 2025—will not be felt until 2026, creating a timing gap that could affect near-term financial optics. Although management reported a $5 million committed ARR backlog and an additional $5 million in late-stage discussions, there is no guarantee that all deals will close or ramp as anticipated. Moreover, while Dario’s AI initiatives have already enabled meaningful OpEx reductions and efficiency gains, the full benefits are projected over a multi-quarter horizon and subject to implementation risks. Importantly, the company has not committed to any particular strategic path, and there is no assurance that a transaction will be completed. In the absence of a deal, Dario will remain reliant on its ability to maintain client renewals, drive cross-sell expansion, and grow through benefit cycles that are seasonally concentrated. For investors, the current scenario presents both optionality and uncertainty—typical of small-cap digital health names undergoing structural transitions and evaluating external options under public scrutiny.

Final Thoughts

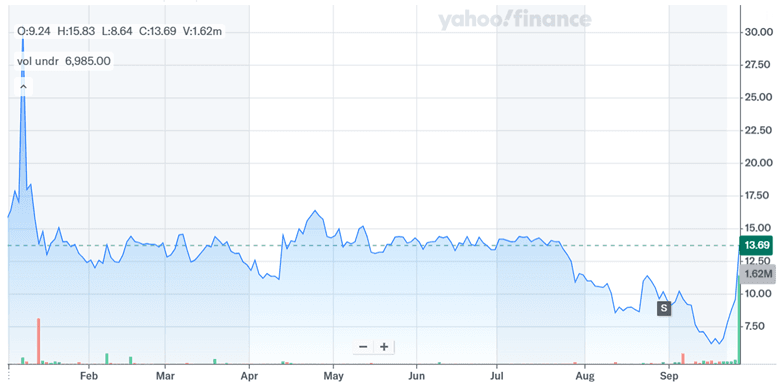

Source: Yahoo Finance

We can see the sharp rise in DarioHealth’s stock price after its decision to launch a strategic review. The rumors regarding the unsolicited suitor interest were clearly taken seriously by market participants which led to the stock price nearly doubling over the past few days. Despite this jump, DarioHealth trades at a modest LTM EV/Revenue multiple of 1.57x and a Price/Sales ratio of 1.21x—well below the 5–10x multiples seen in recent sector transactions. These discounted valuation levels could support a case for strategic value unlock, but only if the company successfully translates its pipeline into scaled revenues or executes a favorable deal. Until then, the market will likely continue to weigh the prospects of a transaction against the backdrop of delayed profitability and execution dependencies.