EOS Energy Enterprises (NASDAQ:EOSE) has soared to an all-time high, fueled by a confluence of policy support, operational scaling, technological validation, and accelerating commercial traction. In recent months, the company has secured a $22.7 million drawdown from the U.S. Department of Energy under a $90.9 million loan commitment, reported 122% sequential revenue growth in Q2 2025, and unveiled a rapidly expanding commercial pipeline valued at $18.8 billion. Additionally, EOS received conditional approval for the full DOE loan guarantee, reinforcing federal confidence in its strategy. This momentum coincides with a rising need for long-duration storage solutions across data centers, microgrids, and utility-scale customers. Despite an insider share sale in August, the stock's 30%+ short interest has made it a candidate for a significant short squeeze, especially as bullish news continues to hit the wire. With management reaffirming 2024 guidance and initiating commissioning of a second manufacturing line, investors are closely scrutinizing the underlying drivers of EOS Energy's valuation breakout.

Policy & Funding Tailwinds

EOS Energy's trajectory has been significantly bolstered by strong federal support, particularly through the U.S. Department of Energy’s Loan Programs Office (LPO). On July 1, 2025, the company received a $22.7 million loan disbursement under a $90.9 million commitment, marking the second drawdown and a vote of confidence in EOS’ long-duration storage capabilities. Importantly, this loan is part of a broader $398.6 million conditional commitment from the DOE—its first for a standalone battery storage technology—that was reaffirmed in Q2. This institutional backing de-risks the company’s capital plan while aligning with federal objectives to build resilient, non-lithium energy storage infrastructure. EOS' flagship product, the Znyth™ battery, based on zinc hybrid cathode chemistry, offers up to 12 hours of storage duration, making it an attractive solution for grid applications beyond the reach of conventional lithium-ion batteries. The DOE’s support reflects broader industrial policy goals—namely domestic energy manufacturing, critical mineral independence, and decarbonization of the grid. Additionally, EOS stands to benefit from the Investment Tax Credit (ITC) included in the Inflation Reduction Act, which makes standalone storage projects eligible for up to 30% tax credits. As developers and utilities race to take advantage of these incentives, EOS’ domestic manufacturing footprint positions it well to win new orders. With the company already supplying projects backed by major EPC firms and infrastructure funds, these federal policy tailwinds serve as both financial catalysts and commercial endorsements that differentiate EOS from early-stage battery peers still reliant on equity financing.

Operational Scale & Margin Path

Operational momentum is translating into scale efficiencies that are beginning to improve EOS Energy's financial profile. In Q2 2025, the company achieved a 122% sequential increase in revenue, marking its highest-ever quarterly sales. This surge was primarily driven by project deliveries to Pine Gate Renewables and Bridgelink Engineering, and EOS is now actively commissioning its second production line at the "Project AMAZE" facility in Pennsylvania. The new line, which will be qualified in Q3 and ramp in Q4, is expected to improve production throughput and reduce unit costs. Additionally, EOS is localizing its supply chain, with over 90% of materials sourced domestically and most vendors within a 200-mile radius. This shift reduces logistics overhead and is expected to improve gross margins from their current deeply negative levels. While still in the red, adjusted EBITDA margins showed sequential improvement, and management reaffirmed 2024 revenue guidance of $45 to $75 million. The company also ended the quarter with $69.6 million in cash and an additional $25 million drawn post-quarter, providing some liquidity cushion as it pursues breakeven operations. Notably, management indicated that the company is approaching a "crossover" point where manufacturing costs drop below ASPs on a per-pallet basis. This inflection is expected in Q4 2025, supported by labor efficiency, automation, and continued process optimization. For a company trading at high LTM EV/revenue multiples (~87.5x), the visibility into margin inflection is crucial for sustaining investor confidence.

Technology Differentiation & Safety

At the heart of EOS Energy’s investment thesis lies its proprietary Znyth™ battery, which leverages zinc hybrid cathode chemistry as an alternative to lithium-ion. This technology is particularly suited for long-duration storage (3-12 hours), thermal resilience, and fire safety—differentiators that are gaining importance in grid applications. Unlike lithium-ion systems, Znyth batteries operate without the need for HVAC, thermal management, or fire suppression systems, which can be costly and space-intensive. During Q2, EOS completed UL9540A Phase 3 and 4 testing, validating the product's thermal safety and qualifying it for broader commercial deployments. The battery is non-flammable and does not rely on scarce or geopolitically sensitive raw materials such as cobalt or nickel, thereby aligning with ESG mandates and supply chain resilience goals. These attributes make the Znyth system especially attractive for siting near critical infrastructure, including data centers and urban substations, where fire risk is a major concern. Furthermore, the modular design and 20-year life expectancy enable superior lifecycle economics for customers focused on TCO (Total Cost of Ownership). From a competitive landscape perspective, EOS’ product addresses a niche that lithium-ion and flow batteries have not yet economically captured: high-cycle, daily cycling in mid-duration (4-10 hour) applications. With the addition of advanced control software and AI-based fleet analytics, EOS is also building a digital layer that enhances asset optimization and grid integration. These technology features are gaining traction with both traditional utilities and newer customer types like data center developers and independent power producers.

Demand Pipeline & Customer Mix Shift

EOS Energy’s record-high valuation is also underpinned by robust forward demand signals, as evidenced by its growing pipeline of commercial opportunities. In Q2 2025, the company reported a pipeline worth $18.8 billion across over 100 active accounts. Importantly, EOS is witnessing a customer mix shift—from early-stage developers and pilot-scale microgrids to larger, creditworthy counterparties including data center operators, EPCs, and institutional infrastructure funds. For instance, Bridgelink Engineering and Pine Gate Renewables represent repeat customers, with future project phases already scoped and funded. EOS is also engaged in advanced negotiations with utilities and Fortune 500 firms, several of which are pursuing procurement strategies that prioritize domestic content and long-duration storage. The company’s ability to secure long-term supply agreements (some extending beyond 2026) provides visibility into future cash flows and reduces dependency on sporadic project awards. On the demand side, data centers are emerging as a new growth vertical due to their escalating power requirements and need for grid resiliency. EOS reported pilot installations with hyperscale co-location developers and confirmed that its Znyth battery meets Tier 1 uptime criteria for mission-critical applications. Additionally, the product’s modularity and safety profile enable colocated deployment without violating data center siting norms. Beyond hyperscalers, EOS is seeing traction with microgrids serving universities, healthcare facilities, and municipalities—segments with more predictable funding cycles and planning horizons. As the Inflation Reduction Act’s benefits ripple through procurement channels and energy transition capex accelerates, EOS appears well-positioned to capitalize on a multi-year storage demand wave.

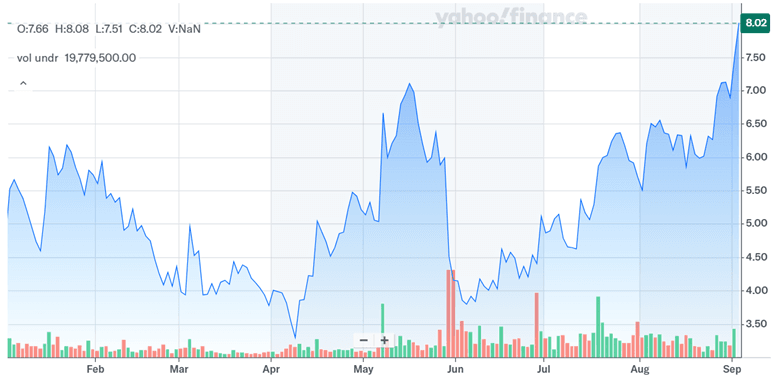

Final Thoughts

Source: Yahoo Finance

EOS Energy’s new all-time high reflects a combination of macro-level tailwinds and company-specific execution milestones. The firm has solidified its position as a federally backed player in the energy storage ecosystem through conditional DOE loan guarantees and ITC eligibility. Operationally, it is progressing toward scale and margin inflection with a second manufacturing line and localized sourcing. Its Znyth™ technology offers safety, duration, and ESG alignment that differentiates it from mainstream lithium-ion alternatives. Finally, a maturing pipeline of $18.8 billion with a shift toward institutional buyers enhances visibility into sustained growth. However, the valuation reflects significant expectations. From a valuation standpoint, EOS trades at 87.49x LTM EV/revenue and 62.04x LTM price/sales, with negative EBITDA, EBIT, and FCF multiples—highlighting the lack of current profitability. Despite improved gross margins and operational progress, the company’s valuation remains vulnerable to execution delays, funding constraints, or shifts in policy support. In essence, EOS Energy’s valuation surge is backed by real strategic progress, but the market is also pricing in near-flawless delivery across manufacturing, sales, and capital markets.