PagerDuty (NASDAQ:PD), the San Francisco-based digital operations platform, is reportedly exploring a potential sale after receiving inbound acquisition interest from both strategic acquirers and private equity firms. According to Reuters, the company has hired Qatalyst Partners to assist in evaluating these approaches, which are still in the early stages. Shares of PagerDuty surged more than 10% on the news, pushing its market cap to around $1.5 billion. While this isn’t the first time the company has explored a sale—previous efforts in late 2023 failed to yield an acceptable offer—this new round of interest comes at a pivotal time. PagerDuty is showing strong margin expansion and approaching GAAP profitability while positioning itself as essential infrastructure in the AI era. Its platform now serves blue-chip clients like Cisco, Shopify, Zoom, and the New York Stock Exchange. The current backdrop of soft valuation multiples, a maturing enterprise salesforce, and an expanding AI use case landscape is likely drawing suitors eager to capitalize on its long-term potential.

Strategic Acquirers Could Gain A Scalable AI-Ready Operations Platform

For strategic buyers—particularly cloud infrastructure providers, cybersecurity firms, or IT observability platforms—PagerDuty represents a compelling asset to deepen their enterprise offerings. Over its 16-year journey, the company has evolved from a developer-centric on-call automation solution into a full-fledged Operations Cloud, offering AI-driven incident management, AIOps, automation, and post-incident analytics. With integrations into major platforms like AWS, Zoom, and Microsoft Teams, and over 700 integrations across the IT stack, PagerDuty has built a sticky ecosystem that sits at the intersection of incident detection, response orchestration, and resolution. Its platform handles unstructured, real-time operational data that traditional monitoring tools often miss, making it highly complementary for acquirers looking to enhance observability or reliability products. Furthermore, with leading generative AI firms like Anthropic and Scale AI as customers, PagerDuty is already positioned as mission-critical infrastructure for emerging AI workloads. These capabilities provide strategic acquirers with an accelerated route to penetrate AI-native verticals while also bolstering their ability to offer reliability-as-a-service to large enterprises undergoing digital transformation. The company’s consumption-based pricing, strong gross margins of 86%, and demonstrated ability to land 6- to 7-figure multiyear enterprise deals only add to its attractiveness. Strategic buyers could view PagerDuty as a bolt-on platform that amplifies their end-to-end value proposition in cloud-native infrastructure management and digital resiliency.

Private Equity Sees A Profitable Turnaround Play With A Recurring Revenue Base

For private equity firms, PagerDuty checks several boxes as a textbook software buyout target. The company has a recurring revenue base with $496 million in ARR, a high gross margin profile (86%), and is generating free cash flow with a 24% margin in Q1 FY26. Importantly, PagerDuty has also provided forward guidance pointing to GAAP profitability by FY27. With more than $597 million in cash and investments on the balance sheet, and no debt, there’s financial flexibility to engineer a leveraged buyout with moderate risk. Operationally, the business has already undertaken substantial transition efforts—overhauling its enterprise sales motion, realigning pricing from seat-based to consumption-based, and embedding AI features across its tiers. While some execution gaps led to elevated churn in the commercial segment and downgrades in enterprise accounts during Q1 FY26, these are largely seen as short-term dislocations due to rep turnover and territory reassignments. With a maturing salesforce—over 60% of reps will be ramped by end-Q2—and high expansion potential among underpenetrated enterprise accounts, a PE firm could execute a value creation strategy centered on ARR expansion, cost optimization, and focused sales enablement. Additionally, the recent decline in LTM valuation multiples to 2.80x revenue and 3.36x gross profit may give PE firms a compelling entry point relative to historical norms, especially considering that the forward EV/EBITDA multiple now stands at 11.84x.

Data Moat & AI Capabilities Make It A Unique Asset In An Overcrowded Market

In an infrastructure software space increasingly flooded with AI-driven solutions, what sets PagerDuty apart is its proprietary data moat and embedded intelligence from over 15 years of operational telemetry. This includes infrastructure, application, and UI-level signals; workflow performance analytics; and machine vs. human triage success rates. The company’s AIOps and event-to-code framework leverage this data to recommend resolutions and auto-remediate incidents in real time—capabilities that few competitors can match at scale. Its platform is also built with a third-party model in mind, offering resiliency when internal systems are down, and increasingly functioning as the operational layer atop clients' IT and AI stacks. PagerDuty has successfully launched new products like PagerDuty Advance and the AI Scribe agent, which transcribes and summarizes incidents from Zoom or Teams calls. With three more generative AI agents planned this quarter and successful integrations with Amazon Q and Bedrock, the company is embedding itself deeper into enterprise AI workflows. For acquirers or investors seeking exposure to mission-critical infrastructure with defensible IP and actionable AI utility—not just buzzwords—PagerDuty’s operational AI focus and customer validation in sectors like financial services and federal agencies provide a strong proof point. This defensibility can reduce long-term churn risk and justify pricing power, both of which are attractive in the current margin-sensitive environment.

Why A Sale Might Also Benefit PagerDuty

From PagerDuty’s perspective, a sale—especially to a strategic partner or a financially supportive sponsor—could offer significant advantages in navigating the complexity of its enterprise transformation and competitive positioning. The company is shifting from a developer-led land-and-expand model to a top-down, platform-centric enterprise motion, requiring deeper investments in professional services, customer education, and long-cycle deal engagement. Additionally, managing multiple AI product launches, compliance initiatives like FedRAMP Moderate, and geographic expansion, all while maintaining margin discipline, is a resource-intensive balancing act. A strategic acquirer could accelerate PagerDuty’s go-to-market capabilities, cross-sell platform adoption across a larger install base, and unify adjacent services under one enterprise suite. For PE firms, operational know-how and sales efficiency improvements could help drive accelerated ARR growth and unlock more meaningful EBITDA leverage.

Final Thoughts

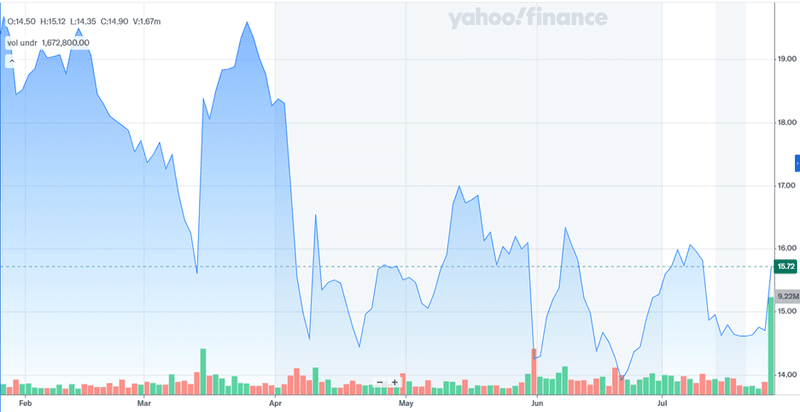

Source: Yahoo Finance

We see a notable rise in PagerDuty’s stock price and traded volume after the announcement of the company exploring a potential sale. However, if we look at the overall trajectory, the company’s stock has been volatile and is far away from its 6-month high and its 52-week high levels. Interestingly, PagerDuty’s stock has seen valuation compression, with LTM EV/Revenue down to 2.80x and NTM EV/EBITDA hovering at 11.84x—levels that are not overly demanding for potential acquirers relative to the broader SaaS peer group. Overall, we believe that its rapidly maturing product suite, proprietary data advantage, and rising importance in AI-driven operations make it a scarce asset in an increasingly competitive landscape. While a deal is not guaranteed, PagerDuty’s strategic posture and valuation reset may continue to attract attention in a consolidating market.