Phreesia (NYSE:PHR) is charting new territory with its recently announced $160 million all-cash acquisition of AccessOne Parent Holdings, a healthcare financing firm with a receivables portfolio of $450 million. If completed, the acquisition is expected to contribute $35 million in annualized revenue and $11 million in adjusted EBITDA, while expanding Phreesia’s total addressable market (TAM) by roughly $6 billion. This comes at a time when Phreesia reported its first-ever quarter of positive net income, driven by solid growth in its Network Solutions and Provider businesses, alongside a growing suite of AI-powered offerings like VoiceAI. With the AccessOne deal, Phreesia is aiming to strengthen its healthcare payments platform and expand its presence in patient financing—but will this all work out? Let us find out!

Seamless Expansion Into Healthcare Financing With No Direct Risk Exposure

One of the most compelling synergies for Phreesia in acquiring AccessOne is the strategic extension into healthcare financing without the downside of credit risk exposure. AccessOne enables healthcare providers to offer flexible, long-term payment plans to patients, which enhances collection rates while preserving the provider-patient relationship. Importantly, Phreesia will not bear the credit risk associated with these financing plans; instead, that responsibility is shared between providers and PNC Bank, AccessOne’s long-standing capital partner. This means Phreesia can participate in the economic upside of facilitating patient financing without adding credit risk to its balance sheet or requiring regulatory licenses associated with lending. The acquisition allows Phreesia to integrate AccessOne’s offerings into its existing Provider Solutions platform, giving clients a broader, more robust payment suite. This bundling opportunity is particularly valuable for hospitals and health systems seeking unified, tech-first payment solutions. AccessOne already has strong health system penetration and deep relationships with providers—many of which are already clients of Phreesia’s intake platform—offering immediate customer overlap that could drive faster integration. Furthermore, AccessOne’s receivables portfolio of $450 million provides scale and credibility, validating its product-market fit in a fragmented, $6 billion TAM. Phreesia, which previously couldn’t enter this market due to regulatory and operational constraints, now acquires an established infrastructure and team capable of executing within the niche. The company’s historical reluctance to enter the financing space without a proper structure reflects its conservative approach to risk. But through AccessOne, Phreesia is now positioned to scale financing services responsibly, aligning with client needs while enhancing monetization at multiple points along the patient journey.

Revenue & Margin Accretion From A High-Quality Asset

Phreesia expects AccessOne to add $35 million in annualized revenue and $11 million in annualized adjusted EBITDA—marking one of the few acquisitions in its history with immediate profitability. At current run rates, this suggests an EBITDA margin north of 30%, significantly above Phreesia’s standalone margin profile. This not only boosts Phreesia’s consolidated financials but also creates a platform for long-term operating leverage. With Phreesia’s Q2 FY2026 adjusted EBITDA already at $22 million and margins at 19%, the AccessOne acquisition could lift blended margins further if integration is executed effectively. Importantly, Phreesia reached positive net income for the first time in Q2, with a modest $0.7 million profit and four consecutive quarters of positive free cash flow. Adding a high-margin, cash-generative asset at this stage of the company’s evolution offers a counterbalance to its historical cash burn and muted profitability metrics. Additionally, AccessOne’s scale and economics are compelling relative to its market position. While the company’s revenue base may appear small compared to the estimated $6 billion TAM, its embedded partnerships with health systems and PNC Bank suggest defensible positioning that could be scaled further under Phreesia’s product and go-to-market infrastructure.

Enhanced Product Stickiness & Patient Engagement Touchpoints

The integration of AccessOne adds an entirely new layer of patient engagement to Phreesia’s platform, allowing it to expand beyond intake and administrative workflows into the post-visit financial lifecycle. AccessOne’s financing tools help patients manage large out-of-pocket costs by offering structured, tech-enabled payment plans. This positions Phreesia to be involved at more touchpoints in the patient journey—from pre-registration and appointment scheduling, to visit intake, clinical communication, and now, financial closure. Such breadth enhances Phreesia’s value proposition to providers, who are increasingly seeking consolidated platforms to reduce administrative burden and vendor sprawl. With the healthcare system shifting toward consumer-friendly payment models, the ability to offer seamless, embedded financing can be a critical differentiator. AccessOne’s workflows can be tightly integrated into Phreesia’s intake and payment systems, creating a frictionless experience for patients while boosting provider collection rates. Moreover, Phreesia’s existing AI capabilities—such as VoiceAI and automated referral management—can now be extended into AccessOne’s footprint to further improve patient interaction and self-service options. The strategic overlap between the two companies’ client bases also allows for rapid deployment and feedback loops, helping improve product-market fit and stickiness. Phreesia has long emphasized a “land and expand” model, and AccessOne’s integration could deepen relationships with enterprise clients by offering new tools to address one of their biggest challenges: patient collections. In a post-COVID environment where providers face rising bad debt and reduced reimbursement, Phreesia’s expanded toolkit may provide much-needed relief and cement its role as a mission-critical platform in healthcare.

TAM Expansion & Cross-Sell Pathways Across Network Solutions

Beyond Payment Solutions, the AccessOne acquisition may offer indirect but material benefits to Phreesia’s Network Solutions segment, which grew 25% year-over-year in Q2 FY2026. Though management clarified that AccessOne’s contribution will primarily affect Payment Solutions TAM—expanding it by $6 billion—there may be second-order effects that bolster Network Solutions revenue. By embedding itself deeper into health systems through AccessOne, Phreesia expands its provider footprint and gains more patient engagement points, which can be monetized through targeted health content and life sciences campaigns. The VoiceAI product, which is already showing strong traction and positive provider feedback, could potentially be layered onto AccessOne workflows to facilitate proactive communication about payment options, improving both patient outcomes and monetization opportunities. Moreover, many of AccessOne’s customers are health systems and specialty networks—precisely the kind of high-value providers that Phreesia has been targeting for broader product penetration. This opens up potential for cross-selling existing modules, such as automated intake, referral management, and consent tools, into AccessOne’s install base. Conversely, AccessOne's financing capabilities could be sold into Phreesia's 4,467 average healthcare services clients, accelerating upsells and expanding wallet share per client. This bidirectional cross-sell potential supports a more unified platform vision and enhances customer lifetime value. Importantly, Phreesia’s approach to product launches—often beginning as free offerings before scaling to monetized solutions—suggests that its expanded touchpoints can facilitate faster adoption of experimental or AI-based tools. While management remains cautious in framing AccessOne's role in Network Solutions’ TAM, the structural overlap suggests the acquisition could reinforce both strategic pillars of Phreesia’s business model.

Final Thoughts

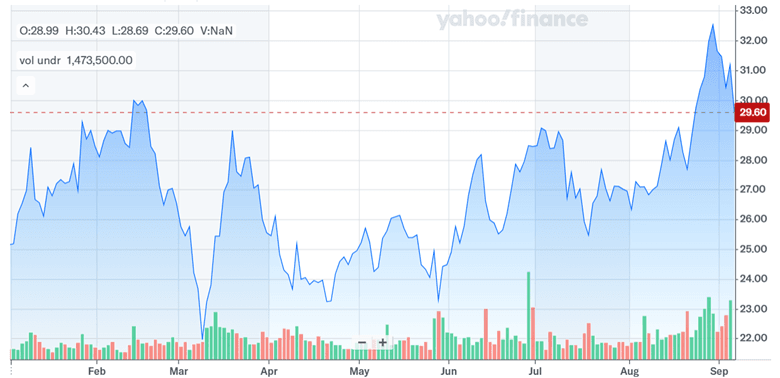

Source: Yahoo Finance

Phreesia’s stock price has been volatile but has had an upward trajectory. From a valuation lens, Phreesia trades at a relatively high 3.94x LTM EV/Revenue and 4.13x LTM P/S, with forward EV/EBITDA at 17.98x. This valuation suggests that any failure to extract synergies or accelerate AccessOne’s growth could weigh on its multiple expansion. The deal is structured conservatively, with no equity issuance and a bridge loan that preserves shareholder value—especially critical in a rising rate environment. The margin accretion potential combined with synergistic cross-sell opportunities may offer a meaningful financial uplift over time. Overall, we believe that the AccessOne deal is best viewed as a double-edged sword—one that could either enhance Phreesia’s platform value and financial profile or strain its resources if integration or scaling efforts falter.