In one of the most significant small-cap semiconductor deals in recent years, Veeco Instruments (NASDAQ:VECO) announced a $4.4 billion all-stock merger with Axcelis Technologies (NASDAQ: ACLS) aimed at forming a high-performance semiconductor capital equipment company. The deal will see Axcelis shareholders own 58% and Veeco shareholders 42% of the combined entity, which will operate under a new name and ticker by the second half of 2026. With advanced packaging, EUV lithography, and AI-led semiconductor demand reshaping industry capex trends, Axcelis appears to be betting big on Veeco’s enabling technologies to build a diversified and competitive platform. However, this may not be the only rationale behind this deal. Let us dive deeper and analyze the biggest reasons that help explain this acquisition interest and the potential synergies at play.

Exposure To Strategic Semiconductor Growth Inflections

Axcelis’ interest in Veeco appears tightly linked to Veeco’s exposure to critical semiconductor manufacturing inflections. The company holds leadership positions in multiple process technologies that are accelerating due to AI, high-bandwidth memory (HBM), gate-all-around (GAA) architectures, and EUV lithography. Veeco’s laser spike annealing (LSA) system is already a production tool of record for major logic and DRAM customers, and its next-generation nanosecond annealing (NSA) tools are undergoing evaluations at Tier 1 customers. These thermal process tools are increasingly required as device geometries shrink and new power delivery architectures emerge, making Veeco’s annealing segment a potential $1.3 billion served available market (SAM) by 2029. Additionally, its ion beam deposition (IBD) systems are uniquely positioned in EUV mask blank production and for critical thin film steps in front-end semiconductor processes. With SAM estimates of $350 million for IBD in front-end applications and $120 million for EUV mask blanks, Veeco delivers specialized capabilities that are otherwise unavailable at scale. The traction is evident—its semiconductor segment represented 75% of Q2 revenue and grew 13% YoY, backed by record advanced packaging revenues driven by AI. This overlap of process technology and end-market relevance creates a strategic synergy with Axcelis, which is also capitalizing on GAA and power device trends through its implant systems. The combination of annealing, deposition, and implant could form an integrated toolset for next-gen nodes—positioning the merged firm to outperform broader wafer fab equipment (WFE) market growth.

Complementary Product Portfolio & Diversified Customer Base

The merger offers Axcelis immediate access to Veeco’s complementary customer base and a broader tool portfolio that spans deposition, annealing, lithography, and wet processing. While Axcelis has traditionally focused on ion implantation systems for advanced logic and power semiconductors, Veeco extends the product offering across back-end and packaging segments. Its wet processing and lithography systems have already gained traction in advanced packaging for AI applications, particularly among OSATs and IDMs. In fact, Veeco is forecasting that its advanced packaging business will double YoY in 2025 due to strong momentum in 3D packaging and HBM integration. This creates a broader addressable market for the combined company, unlocking new growth avenues in high-performance compute and AI-centric workflows. Furthermore, Veeco's global customer footprint complements Axcelis’ existing base, especially in Asia where Veeco recently generated 59% of revenue (ex-China), including strong sales in Taiwan and Southeast Asia. The China exposure, while tapering due to a natural decline in 28nm and 40nm fab builds, still accounts for 30% of first-half revenue and provides room for continued servicing and upgrades. Together, the two firms can offer a more comprehensive value proposition to foundries, IDMs, and OSATs alike—enhancing cross-selling potential, aligning R&D investment cycles, and reducing customer acquisition costs. The diversified exposure also cushions cyclicality risk, creating revenue durability across leading and trailing-edge nodes.

Robust R&D Synergies & Evaluation Pipeline

A critical aspect of Axcelis’ attraction to Veeco lies in its extensive evaluation pipeline and R&D leverage. Veeco’s model relies heavily on getting tools qualified as production equipment at Tier 1 logic and memory customers. Once qualified, these tools can drive follow-on business of $30 million to $60 million per application at scale. During Q2, Veeco confirmed the successful progress of several NSA and IBD 300 evaluation systems, with additional tool shipments scheduled for late 2025 and into 2026. Moreover, Veeco expects continued NSA system evaluations to expand in 2026, including with a third logic customer. This “land and expand” model has worked well in securing repeat orders and deepening integration into customer roadmaps. From a financial synergy standpoint, Axcelis can consolidate overlapping R&D pipelines, reduce duplicate engineering investments, and align product roadmaps across deposition and implant solutions. Additionally, shared customer engagements open the possibility for joint development agreements (JDAs) that span more of the process stack—e.g., from ion implantation to annealing to deposition. The cumulative effect is enhanced innovation velocity without proportionate increases in R&D spend. With the combined entity expected to maintain a $387 million adjusted EBITDA base (pre-synergies), pooling R&D resources could further expand margins and improve returns on innovation over time.

Final Thoughts

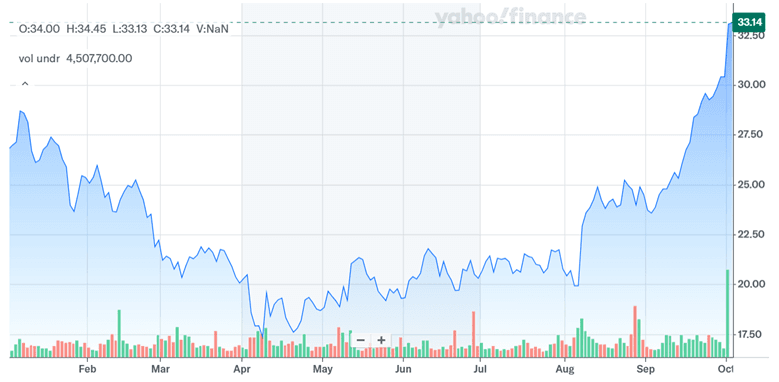

Source: Yahoo Finance

We can see Veeco’s stock price zoom up after the proposed merger with Axcelis was announced. While Veeco trades at elevated valuation multiples compared to historical levels, its growth positioning and profitability profile may justify the premium in Axcelis’ view. Veeco’s LTM EV/EBITDA multiple stands at 22.6x and EV/Revenue at 2.71x. Its LTM P/E multiple reached 32.4x, with a free cash flow yield of just 0.4%—implying minimal current cash generation but significant embedded growth expectations. However, these metrics are distorted by Veeco’s small-cap nature and recent stock performance rebound. Axcelis may view this as a strategic moment to acquire high-quality technology assets before evaluation wins convert into full-scale production orders and before gross margin improvements push valuation multiples higher. The timing could be particularly advantageous in light of Veeco's recent R&D heavy phase and ramping advanced packaging exposure—two elements that tend to precede accelerated revenue and margin expansion. For Axcelis, paying a valuation premium today may be outweighed by the multi-year upside potential in both revenue synergies and operational efficiency gains.